Ad spend in retail media, search and social grew in 2022 (report)

Omnichannel marketing platform Skai has recently released its 2022 Digital Marketing Quarterly Trends Report, finding robust increases in ad spending across various channels.

Omnichannel marketing platform Skai has recently released its 2022 Digital Marketing Quarterly Trends Report, finding robust increases in ad spending across various channels.

The report analysis was drawn from a population of approximately US$9 billion in advertising spend over five quarters, comprising more than 3,000 advertiser and agency accounts across 40 vertical industries and more than 150 countries running on the Skai™ platform on Google, Microsoft, Baidu, Yandex, Yahoo! Japan, Verizon Media, Amazon, Walmart, Instacart, Criteo, Apple Search Ads, Pinterest, Snapchat, Facebook, and Instagram.

Core trends

Spending grew faster than expected, as emerging solutions to new online privacy controls encouraged more consistent spending than last year. Segments that were heavily disrupted by IDFA seem to be snapping back, particularly Local/SMB and Commerce.

Spending levels were mostly unchanged from last quarter, yielding growth of 11% over last year. More sophisticated ad formats and bidding strategies continue to drive growth as they replace legacy options.

Advertisers continued to invest in retail media ad spending, driving total expenditures up 42% over Q2 of last year. Ads for CPG products are proliferating on newer retail media networks like Instacart and Kroger, driving overall growth.

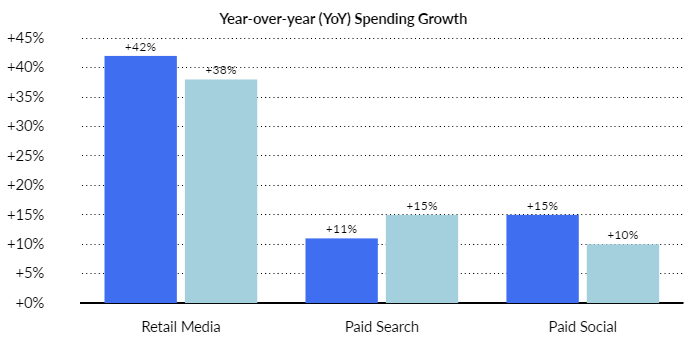

Overall spending growth continues

Retail media growth accelerated 42% year over year (YoY) in Q2 as advertisers continued to grow spending both on Amazon and the ever-increasing field of other retail media networks. Paid social media spending growth grew 15%, as 2022 has proved a more stable spending environment than the same period last year, which was disrupted by increased user privacy controls on Apple mobile devices. Paid search spending increased 11% YoY.

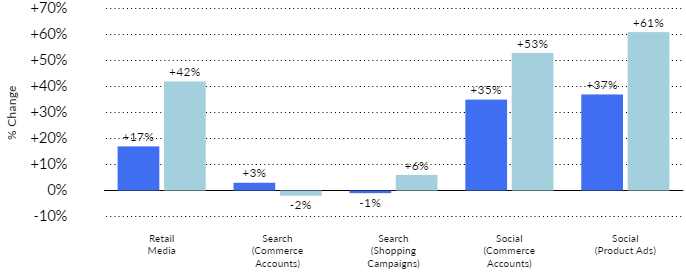

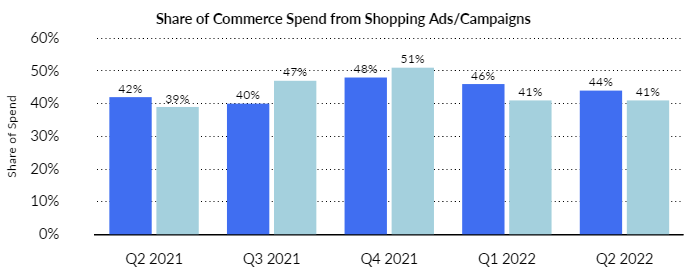

Shopping a big factor across channels

Retail media growth was, by definition, driven by more brands trying to reach a larger group of shoppers while they are in-market. Paid social spending growth in the quarter also benefited from investment on commerce-focused ad types and from commerce-focused advertisers. It was only in paid search where investment appeared to follow the macroeconomic trend away from goods and toward services.

Social advertisers are adjusting to IDFA

2021 saw sequential spending declines from April to May to June as the release of iOS 14.5 introduced changes to privacy controls and availability of data for both targeting and measurement. With a myriad of solutions and workarounds in place for these disruptions this year, monthly spending in paid social media has been much more stable in 2022, paving the way for an acceleration of growth.

Responsive Search Ads now dominate search spend

The migration of paid search from the Expanded Text Ad (ETA) format to the Responsive Search Ad (RSA) format has reached the point where RSA is now dominant, comprising 38% of total Q2 spend compared to just 23% in the second quarter last year. ETA spend has dropped from 40% to 27% of spend over that same time period, with shopping ads making up most of the balance.

Save time and money when creating and distributing high-quality content for branding and marketing with ContentGrow. Sign up to get your campaign started or book a quick call with our team to learn more.